Teaching children about money doesn’t have to be complicated. Here are 10 simple ways to teach your children about money!

- Show your children coins and bills. Let them see, feel and hold it. Talk about the shape, colour and the images on the money. Explain the sizes and values. In Canada, this can be particularly fun for kids. Try rolling a new loonie. Compare that to how the toonie rolls. Ask them questions…Which do you like the best? Which one do you think is worth the most at the store? Be engaging and answer their questions.

- Buy a piggy bank with them. Let them help choose the one that they will enjoy putting money into. Some have musical mechanisms that play a tune each time a coin is placed inside or up-cycle a clear water bottle and decorate it for them so they can watch their money as it accumulates.

- Give them spending money from time to time. A dollar or five as you can afford on a regular basis i.e. Every Saturday or every other week. This allows them to begin to accumulate money in their piggy bank and offers a starting point that opens up the world of money to them.

- Let them earn money. Teach them the value of their earned dollars. As children every Saturday we used to have a chore list. Mom would hang it on the fridge and we would compete to get the most money by completing certain tasks. Dust the living room was 15 cents, vacuum the main floor was 25 cents, clean the windows 50 cents, fold the towels 50 cents, sweep the kitchen 15 cents, wipe down the cupboards 50 cents, and so on. It was exciting for us…like a competition to see who would get the most done and earn the most money. If we didn’t feel like doing chores that was fine but we wouldn’t get the money for chores either.

- Talk to your children about their money as it begins to accumulate. Encourage them to think about what they would like to buy in the next week, next month and in the future. This will help them to think about money in terms of goal reaching. Decorate envelopes with pictures of their goals. If he/she would like a new video game you can research with them to find pricing and then offer to pay for half of the game once they have saved enough to pay for the other half. It’s important to follow through on this though so only make those promises that you are able to keep. Even if that is just offering to drive them to the store on the weekend once they have enough money saved for the video game.

- Consider opening a bank account or savings account with your child. Let them talk to the bank teller and feel proud of themselves for having some money to put in the bank. Continue to make deposits with them and observe the transactions online as they grow. Encourage savings and continue to talk about their goals or plans for the money in the future…backpacking around Europe, buying their first car or visiting an aunt and taking her a special gift. Keep the conversation positive and encouraging.

- Consider asking your child for a small loan. Ask the child if they could loan a sibling a dollar or two. Explain that in exchange for the loan of a dollar or two that it will be repaid with interest. Interest is a bonus that the person or institution that lends will make in return for lending money. Define the terms – Cindy will repay you on Thursday when she gets her allowance and mom/dad will give you an additional quarter in interest. Usually, the child will be agreeable however if he/she is not agreeable, do not force the loan. You always want the experience to be a positive one.

- Talk about the economy generally. When companies are laying off workers don’t be afraid to explain that it’s sad for their families as it is harder to pay bills and buy things like food and clothing when someone is out of work. If you can, bring your child with you to the grocery store that weekend and fill up a bag of food to donate to the local food banks. Remind your child why you are doing this for those who have come upon hard times. This instills in them a sense of community and responsibility to help when they can. (Not just a monetary lesson)

- Open an Education Savings Account for your child. Let your child know that you are supportive of them and want them to succeed. Let them know that you are also saving for their success filled future. Review it with them each year and encourage them to reach their goals. As they get older review the cost of books and tuition and let them know that together by both of you saving so that they will have the opportunity to study anything they would like.

- Lead by example. The biggest money lesson you can teach your child. Create or continue with good spending habits. Value your money and let them see you making choices in your spending when you shop together. Make goals for yourself and each time you reach them to celebrate together. Children pick up on parental behaviours, habits and attitudes towards all different aspects of life. Money is one of those. Model for your children in a positive way and teach them the lessons that they are unlikely to learn in school, on Youtube or in a video game. Have fun!

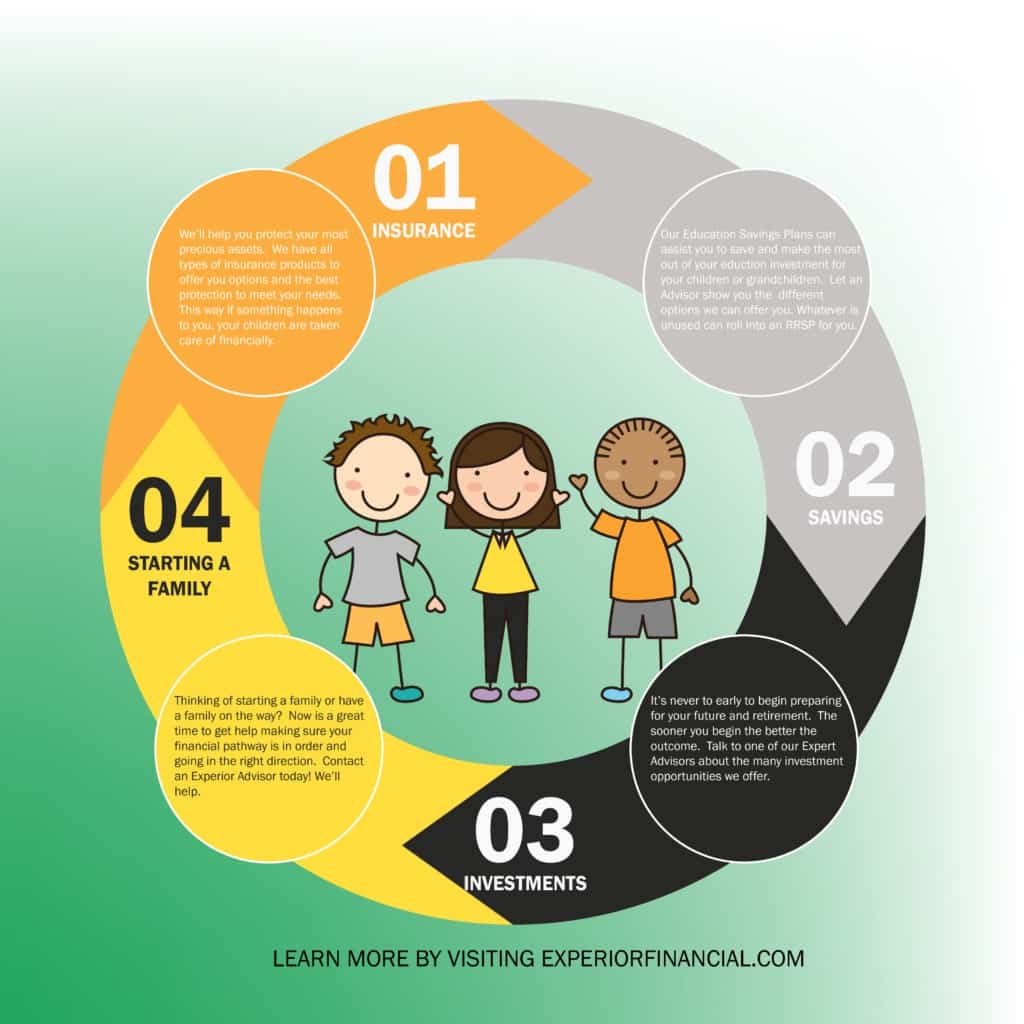

Would you like assistance coming up with a financial pathway for your family? Let one of our Financial Advisors meet with your family to help you save for the future. Our Advisors are happy to help teach your little ones a lesson about money, investing and saving too! Contact us today for your free, personalized no obligation financial needs analysis appointment. We’ll match you up with an expert advisor in your area.