Thinking about a career in sales. It can be very lucrative. A career as a Real Estate Agent/Real Estate Broker or Insurance Agent/Insurance Broker can earn you the kind of living that can set you up for a great financial future and can be very rewarding. These can be great occupations for the right person. A sales professional can make a great income if they work diligently and provide a great client experience. The client experience is everything when it comes to a successful sales career.

Selling can be a challenge, as it takes someone who is self motivated and has the right personality to pull it off. It requires excellent communication skills and the ability to meet your clients needs.

You can also build a team in both of these options. You can have people who go out and do sales while you earn an override by providing training and resources to help them with their success. If you want to be a leader in the sales industry, we believe you will lead by example. Whatever this may look like at your point in business, as it will change as your team grows and different times throughout your life. Both of these career paths can be lucrative as the compensation is commission based. Commissions can be a great thing to have as there would not be any salary cap. It can be very motivating to see your commissions add up month after month but it comes with a requirement to be a self starter. At Experior we have many tools and leaders to help you throughout your career here, however no one will force you to do something, that is why motivation is important.

What is a Real Estate Agent?

An agent must have a Real Estate License in order to participate in the buying and selling of homes or buildings in the real estate industry. They may work out of a real estate office or they may work from a home based office. They work hard to make home sales and provide their clients with a great experience.

A Real Estate Agent also works on commission and makes money once the sale is finalized and the funds for purchase of the property have been paid to the seller.

A Real Estate Agent can help to sell a home or commercial property. They can also do lease agreements for tenants and building owners. They work hard to find properties for sale and customers to fulfill the sales. They study the market conditions so they know what a home or property should sell for and they work closely with their clients to find them the property that suits their needs.

Real Estate Brokers also do quite a lot of paperwork. They submit offers on their clients behalf as well as review offers that come in. They must have good attention to detail to ensure that the paperwork is in order and that the details are all correct.

What is an Insurance Agent?

Life Insurance Agents or Insurance Brokers are people who have trained and met education requirements to become licensed to make life insurance sales and help clients with other financial services. Brokers can contract with several different insurance companies to get their client the best product. The other less desirable choice is the agent can work for one insurance company offering only that company’s product shelf. Brokers aren’t limited to one company for their life insurance sales and can shop the market if they are with a reputable Managing General Agency with contracts of many insurance companies.

An Experior Financial Group Insurance Associate will meet with a client to review and assess their financial situation and come up with a plan to meet their financial needs.

Real Estate Agents can make a great career as Insurance Brokers but there is a bit of a learning curve and they need to meet licensing requirements in their province. Experior Financial Group provides top notch training and support to its insurance associates to help them achieve success in making sales and providing excellent customer service.

Similarities Between Real Estate Agents and Insurance Agents

Working in the insurance industry and working in the real estate industry are not that different. There are many similarities between these career paths.

- Both Real Estate Agents and the Insurance Agent work on commission.

- Both the Insurance Agent and the Real Estate Agent are licensed in their province and answer to regulatory bodies to meet their licensing requirements.

- Both can have any level of education to get started.

- Both the Real Estate Agent and the Insurance Agent carry Errors and Omissions insurance policies.

- Both are sales professionals who make their income from selling to clients.

- Both Real Estate Agents and Insurance Agents carry out market research to ensure they are doing the best for you.

- Both the Real Estate Agent and the Insurance Agent use their experience to serve clients with a high level of care.

- Real Estate Agents and Insurance Agents usually work out of an office under a corporate brand like Remax or Experior Financial Group.

- Both the Real Estate Agent and the Insurance Agent meet clients based on that clients schedule which can mean working outside of the normal 9 to 5 working hours which also can give you a lot of flexibility for family.

- Both can be their own boss and build a business and team of agents that work with them.

- Both can make a great income.

Differences Between A Real Estate Agent and An Insurance Agent

The insurance agent may be able to do the work from home if they utilize technology well and clients are open to meeting online to discuss their insurance policies and finances. A Real Estate Agent generally needs to meet with clients and see either the property they would like to sell or the properties they think the client may be interested in purchasing. This means lots of face to face interaction and sometimes a lot of extra time looking at properties, submitting offers and fulfilling sales.

Insurance Agents can meet with the clients online, face to face, or over the phone to assess their financial situation, and provide recommendations to meet the client’s needs. Once a plan is selected, documentation is secured, a plan in place and subsequently a policy is presented. As advisors become more proficient the time between submission to commission reduces.

A Real Estate Agent will need to meet with clients in their home in order to view the property the agent will be selling. A good deal of time is spent working to find out the needs of the client and arranging things like showings, open houses and working to find the client a replacement home if required.

Insurance Agents are required to complete 30 hours of continuing education credit hours on products and other facets of the industry to meet education requirements every 2 years. These must be met or their license can be revoked. Most Real Estate Agents in Ontario are required to do 8 hours of education every two years to maintain their license.

As you can see there are many similarities and some differences in the content of these two sales careers. Most independent sales positions don’t come with benefits like health and dental insurance. An Insurance Agent can often find themselves highly competitive private insurance packages so that they have the coverage they will need for their families. It takes a certain kind of personality to work for commission and succeed and so many people are successful and they love it.

If you are interested in a career in financial services and insurance sales, reach out to us. We’ll find a leader in our company to walk you through the next steps to becoming a licensed Financial Associate with Experior Financial Group. We have opportunities for both full time and part time Insurance Brokers. No experience needed as we train the right candidates.

Our associates can deal with over 26 insurance companies across Canada. They have access to all the best products on the life insurance market. Our agents and brokers don’t use just one insurance company but many to give the client exactly what they need ensuring our clients are left content with their financial situation. We also offer some of the highest commissions in the industry and a the most comprehensive Legacy Plan that will guarantee long term revenue to you on retirement or disability, or to your family at death.

Who makes the most Commission a Real Estate Agent or an Insurance Agent?

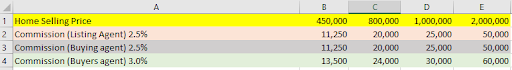

In Ontario there is a 5% commission on the sale of a home that is usually split between the seller’s agent and the buyer’s agent for an average of 2.5% on the sale price. Sometimes the selling agent will agree that the buyer’s agent can have 3% in order to help sell the home faster or for other reasons. Other deals sometimes are made also. For example we will go by 5% total, 2.5% each and also an example of 3%. However this is up to the agents to decide and negotiate when needed.

So depending on the number of real estate sales made in a year that will determine your annual earnings. The lower the price of the home you are selling the lower the commission and the more homes or properties that must be sold. Likewise if the property has a higher selling price than you will require less sales to make higher earnings. There is fierce competition in the real estate market and finding those sales can be a challenge until you’re established. According to Realtor.com the average client looks at 10 homes over 10 weeks before finding the right home. If each home was an hour without worrying about travel time etc that is pretty good.

How about Insurance Brokers who work with Experior? They make the same commission across Canada. There is no difference according to Province but it does vary by the product you sell or the investment you find. Experior Financial Group has some of the highest commissions in the financial services industry. When you are just starting out it can be hard as in all self directed career paths, however, we offer fair compensation for your work and help you build on it as you build your team of agents. You can also get a manager bonus or override based on the work done by your team with your guidance. Keeping up production is important and in our business you will have a team of helpers who can assist you in motivation when needed, for you or your team. Also, our leaders will help with training and other things you may need in your business, we are in business together and we mean it.

Our compensation structure is a little more complex as we have many products. To better understand our full commission system we invite you to speak to one of our associates who can explain our entire compensation structure. Above is just an example of the commissions on Life, Critical Illness and Disability Insurance. We offer many more products and additional ways of earning the income you desire for yourself as an Insurance Broker. Our Brokers spend an average of 1 -2 hours with their clients, this includes any paperwork and planning they do behind the scenes. If you are interested please see our careers page for more details on a career with us. When you submit your information in the contact form you will get an email from one of our associates who will set up a time to answer your questions.