Canadian retirees may not think about life insurance during the early years of retirement, when they are focused on generating income from their investment portfolios. But life insurance can be a useful tool for seniors, especially when it comes to providing for children, grandchildren or other loved ones or funding charities.

Life insurance is a way of protecting your family from the financial hardships that could result if you were to die prematurely. It can also ensure that your loved ones have access to all of your assets, without the worry of taking out complex loans in order to pay unpaid taxes and other expenses that could happen.

As we said earlier, the primary reason people buy life insurance is to protect their dependents. However, there are other situations in which life insurance can be a sound financial investment for retirees.

- To get rid of debt: Your beneficiaries can use life insurance to pay off your debts instead of having to liquidate your assets.

- Covering taxes at death: When you pass away, your estate may incur substantial tax bills. Life insurance can help ensure there is money to pay the taxes.

- To pay final expenses, such as funeral expenses, probate fees and legal fees: It's important to make sure there are sufficient funds in the estate to cover fees and expenses. For some, life insurance is an excellent tool for providing cash at death.

- To leave a larger inheritance for your beneficiaries: If you want to leave money behind for your loved ones, life insurance can be a good way to provide for them. Because it avoids taxes, it can be a good long-term solution.

- To help your family settle your estate: Life insurance can be an excellent source of money to allow your executor to keep things equitable for your beneficiaries when it isn't possible to divide certain items, such as real estate.

- To help businesses remain viable: There are many benefits to using life insurance and estate planning in business. Every situation is unique, which is why you need to work with a team of experts. Experior Associates can help with all of your estate planning.

- Give to charity: Most of the time we donate money to charities by giving them a gift, or by making a direct contribution. Charitable gifting with life insurance is easier. The most attractive advantage of using life insurance is that it allows you to make a much larger gift to a charity. It’s also a great way to save on taxes.

What Types Of Insurance Can A Retired Senior Get?

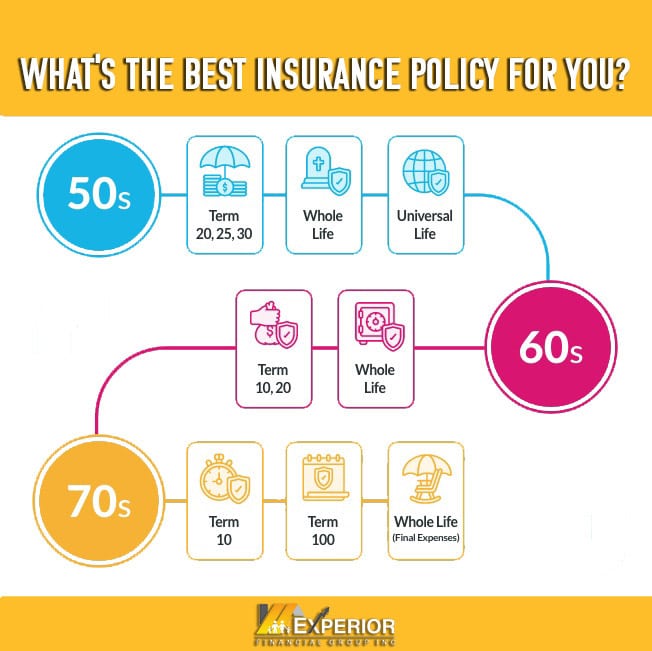

As we get older, life insurance may be desirable for many different reasons, including covering funeral expenses and outstanding debt. While it’s true that premiums for life insurance tend to increase as you get older, an older person can still get very affordable coverage. Seniors will find permanent life policies more attractive, since there are fewer term life insurance options for older adults.

Seniors who need life insurance for a temporary purpose, such as home-owners who need to pay off a mortgage, will find term life insurance more affordable. However, seniors often purchase life insurance to meet end-of-life expenses or leave a tax-free sum of money to their spouse, children, and grandchildren or other loved ones. A permanent form of insurance such as Term-100 or whole life insurance may be more appropriate in these situations. Some insurance companies offer seniors term life insurance, but it is not often available for people over age 75. In addition, seniors with pre-existing medical conditions can choose to get limited coverage, or they can opt for no-medical life insurance policies.

When you retire, one of your most important concerns should be to maintain health insurance. Medical insurance can be very valuable as you age because of increasing health care costs. If you are a Canadian resident and have a valid health card, there are some medical services that are not covered by the public health care system. These include prescription drugs, semi-private or private hospital rooms, and paramedical services like chiropractic care and ambulance transportation. A 2014 poll published by Global News, found that many Canadians fear the costs of health expenses as they age. Those fears are well founded, with respondents expecting to pay $5,391 in out-of-pocket medical expenses every year after the age of 65. Statistics show that Canadians live longer than ever before, and many healthy retirees can expect to live for at least 15 years after retirement. To fill the gap, Canadian retirees should take steps to reduce their medical expenses.

In summary, there are many insurance options available on the market for seniors today. Experior Financial Associates are ready to help you find the right insurance coverage for your unique needs and situation.

How Much Does Life Insurance For Seniors In Canada Cost And Which Factors Affect Insurance Rates And Approvals?

Life insurance rates vary by factors such as your age, gender, smoking status, lifestyle, and overall health. For example, a 60-year-old male in good health could pay approximately $97 per month for a life insurance policy with a death benefit of $100,000. A female who is a non-smoker of the same age could pay as little as $64 per month. By smoking you almost double the cost of life insurance premiums.

As we have mentioned, insurance companies base their premiums on many factors. Consequently, it is difficult to pinpoint how much policies cost and which company offers inexpensive life insurance for seniors in Canada. Instead, we encourage you to speak with an Experior Financial Associate to compare seniors’ life insurance rates offered by different companies. Contact an Experior Financial Associate to get a free, no-obligation life insurance quote. We will help you find the best policy that suits your specific situation and needs.

Why Should You Work With Experior Financial Group?

It can be a challenge to decide on the right life insurance policy. If you’re still not sure what sort of life insurance coverage you want, we can help. Our licensed Associates have decades of experience helping Canadian seniors choose the right insurance coverage for their needs.

Schedule a time to speak with one of our Experior Associates about your options and which product best suits your specific needs. We will provide a free, no-obligation Expert Financial Analysis to help you make the right decisions for you and your family.

FAQ

The cost of life insurance varies greatly. The length of the policy, your age, health, lifestyle, family medical history and smoking habits all affect how much you will be expected to pay for a given policy.

Figuring out how much life insurance you need is a process that’s individualized. You will want to be sure to get enough life insurance so that you can adequately pay off your debts, as well as support your family/dependents for the length of time you were planning to.

If you don’t qualify for traditionally underwritten life insurance and/or you don’t want to go through a medical exam, no medical life insurance could be a good option for you. People who don’t qualify for fully underwritten medical life insurance can apply for no medical life insurance.