Life insurance is a valuable financial asset. It is something you buy for the benefit of others, not yourself. The reason to purchase it is to provide a means of support for the people who depend on your income in the event of you passing away. The amount that you need to purchase depends on the size of your family and their particular financial needs.

You’ll need to purchase enough life insurance to cover the needs of your family. But how much you need depends on your unique situation, and there are some guidelines that can help you figure it out.

What Amount Of Life Insurance Is Right For You?

Experior Associates will conduct an Expert Financial Analysis (EFA) at no cost to you, so you can get a clear picture of how much life insurance you need. They’ll consider things like your annual income, net worth, debts, children’s education and existing life insurance.

The general rule of thumb is that you should have enough life insurance to equal 10 times your annual income. So if you earn $80,000 a year, you would want to have $800,000 in coverage. However, every individual’s financial situation is different and so it is important to examine each situation individually. For example if you would like to pay off debts or your mortgage it could be more than 10 times your income and then things like this would need to be taken into consideration.

The Expert Financial Analysis will help determine your expenses, how much money you need each month and how long you need that amount to last.

You can also use our insurance needs calculator to get a quick estimate on how much life insurance you need before you speak to a licensed Experior Associate.

How Much Does Life Insurance Cost Per Month?

Buying life insurance isn’t as expensive as many people think. Rates vary depending on the type of policy you choose, but you can get a policy that works for you within your budget.

For example, monthly life insurance premiums are about $13 per $100,000 of coverage if you’re a healthy 30-year-old requesting a 10-year term policy with most companies. If you’re 60 years old and smoke, you could be paying over $100 per month for the same amount of coverage. The cost of life insurance in Canada depends on a few factors including gender, age and health status. If you’re in good health for your age and don’t have any major risk factors, you’ll pay lower premiums.

Every Canadian life insurance company weighs these factors differently, which is why you’ll get different rates from different providers. Consulting with a Licensed Financial Associate is crucial, as they will help you determine the amount of life insurance coverage you need for your unique situation at the best available rate. Contact an Experior Associate to get started today!

How Long Do You Need Your Insurance Coverage To Last?

How much insurance you need depends on the person or couple’s age, the amount of debt they have, and whether they have a mortgage. If you’re in your 50’s with little debt and a small mortgage, a 10-year insurance policy might be best. But if you’re younger and have substantial debt and a larger mortgage, a 30-year policy could be best suited to you.

Contacting an Experior Associate will help you make an informed decision about the length of insurance policy that is best for you. Our knowledge of the industry ensures that we will provide you with the best products and rates available.

How Do You Choose The Right Life Insurance For Your Needs?

Your employer may offer life insurance through your benefits package, but you may want to consider getting additional coverage. The types of life insurance you can get, include whole life (permanent) insurance, universal life insurance, and term life insurance.

Unique financial situations call for unique solutions. So it’s best to consult a professional, like an Experior Associate, for guidance. Get in touch with an Experior Associate today.

FAQ

A rough estimate is a good starting point. Add up your financial obligations and subtract any existing life insurance policies and liquid assets to arrive at an approximate figure for how much life insurance you’ll need to provide for your loved ones in an event that you pass away unexpectedly.

However, every person’s financial situation is unique, and many factors come into play when determining how much money you will need for retirement. Each of us has different needs and goals, and we are here to help you chase your dreams. Experior Associates can help you navigate the financial landscape and get on the pathway to financial freedom!

Whether or not you have an immediate need for life insurance, it’s a good idea to get coverage right away. As you age and your health can worsen, the cost of life insurance will increase. So it’s best to purchase a policy while you’re young.

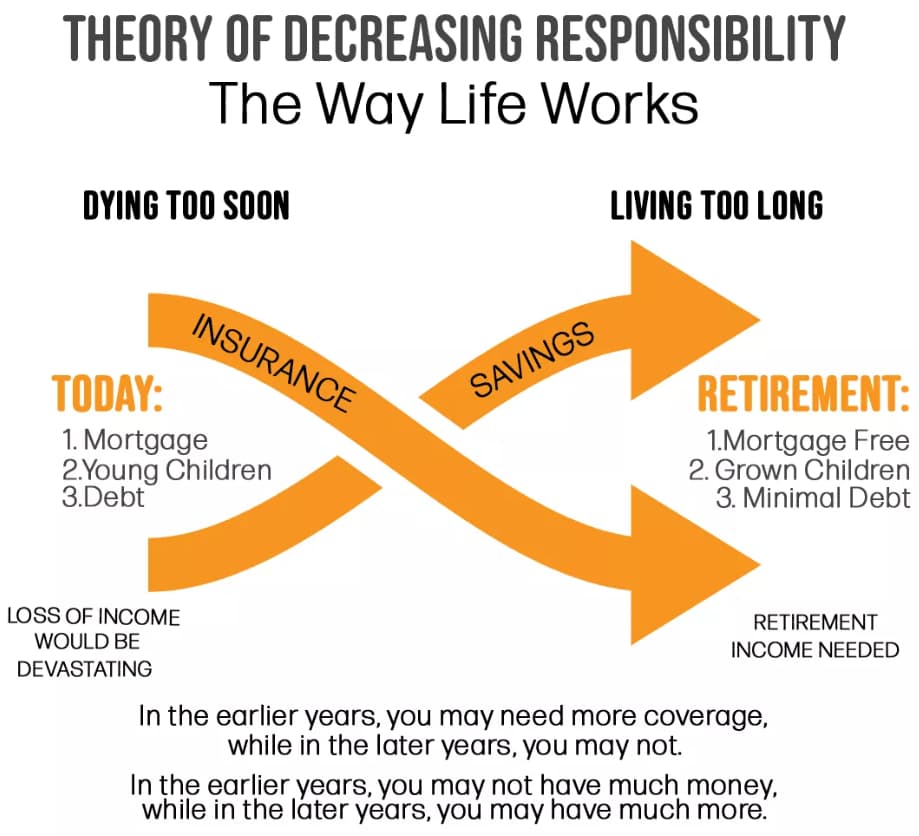

As the illustration below shows, the Theory of Decreasing Responsibility suggests that it’s important to plan for every stage of life and be prepared for the unexpected by having adequate insurance coverage.

If you’re single and supporting someone else, you should get life insurance. This includes any co-signed loans you currently pay, like student loans, which become your co-signer’s responsibility when you die.