Many people looking for insurance coverage may have difficulty at some point in their life getting a policy because they have a developed pre-existing condition. Pre-existing conditions may make things difficult but an Experior Financial Group Associate can help you find an insurance policy to get the coverage you need.

Just because you may have a pre-existing health condition in Canada does not mean you won’t qualify for insurance coverage. It really means that you need someone in your corner who can shop the market for you to help you find the best coverage possible at the best price.

Let’s take a closer look at pre-existing conditions.

What Is A Pre-Existing Condition?

A pre-existing condition is a health condition that the insurance industry determines can be more costly to insure. Examples of these conditions may be mild or serious conditions. Let’s take a look at some of these conditions to help determine what type of pre-existing condition the insurance companies would consider serious or mild.

What Is Considered A Mild Pre-Existing Health Condition?

A pre-existing condition is a health condition that the insurance industry determines can be more costly to insure. Examples of these conditions may be mild or serious conditions. Let’s take a look at some of these conditions to help determine what type of pre-existing condition the insurance companies would consider serious or mild.

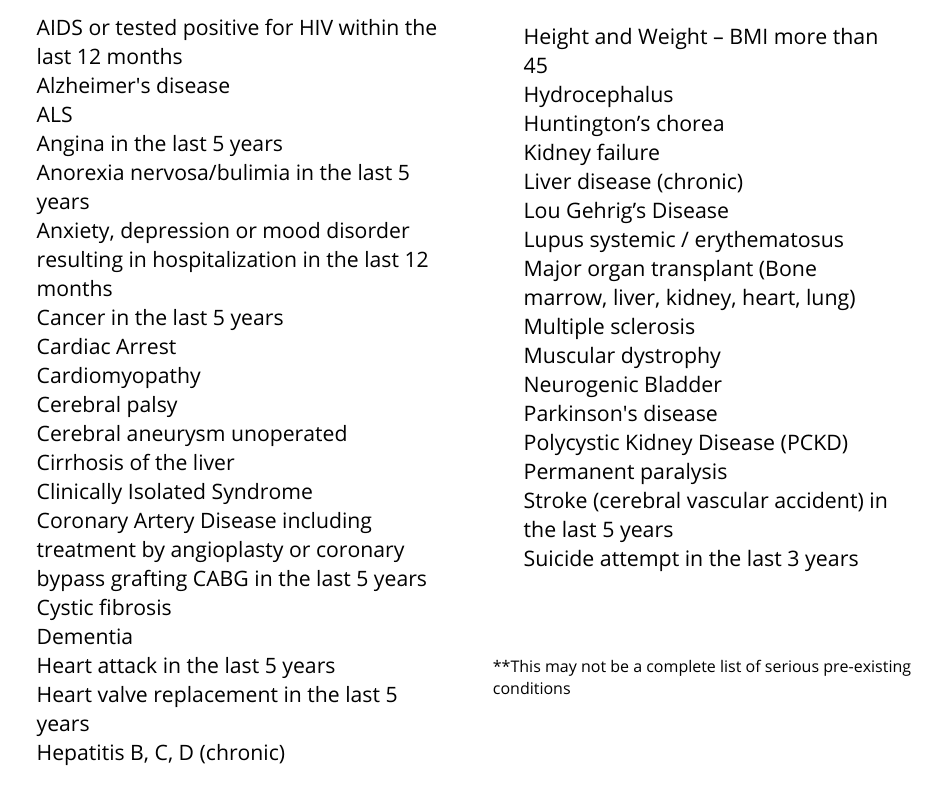

What Is Considered A Serious Pre-Existing Condition?

Serious conditions such as a recent stroke, cancer or heart disease may preclude you from getting coverage until you have been clear of these conditions for a number of years as determined by your physician. An example might be that you had cancer last year but had it removed. It may take several years clear of that cancer before you would qualify for an insurance policy.

Other Serious Pre-Existing Conditions May Include:

What Else May Cause Me A Problem In Getting Coverage?

Well, family medical history can sometimes play a role in the premium you pay for your insurance policy. Having a family history doesn’t mean you won’t get coverage but it can affect the cost of the policy. For example if your mother or father died from heart disease or stroke, the insurance company may believe that you are at a greater than average risk of suffering from these conditions. To protect themselves they would then charge a higher premium to you for coverage as they may be taking on slightly more risk with your policy.

What Types Of Insurance Policies Are Available For Those With Pre-Existing Conditions?

An Experior Financial Associate can help you with your Health Insurance or Life Insurance policy needs. A discussion with one of our knowledgeable and highly trained associates will help them determine your unique coverage needs. Our associates can help you get nearly any type of policy sometimes without medical tests. At Experior we have partnered with over 26 insurance companies so we can shop the market to ensure we get you the best policy that suits your needs and goals.

Contact us today to be set up with an associate in your area who will get you the coverage you need.