When you purchase your home you may be offered Creditor mortgage protection insurance by your bank. Mortgage protection insurance is a product that is sold in order to ensure that in the event of your death or disability, the mortgage lender receives payment on the home. When you are a first time home buyer with no equity mortgage insurance may seem like a good idea.

What is CMHC Mortgage Loan Insurance?

If you buy a home with a down payment of less than 20%, you will need mortgage loan insurance. This insurance protects your lender in case you can’t make your mortgage payments.

You can find out more about CMHC mortgage loan insurance here if you fall into the category mentioned above.

Is There Something Better Than Creditor Mortgage Protection Insurance?

Yes, although CMHC is a mandatory coverage (and different from Mortgage Insurance) for anyone who does not meet the minimum criteria when purchasing a home and this protects the creditor not the client.There are definitely better options for coverage than creditor insurance for you, the client.

Creditor insurance only protects the creditor and remaining balance of your mortgage if you qualify (not known until after death or disability-mentioned below) not the customer. You may want to switch from paying creditor mortgage insurance and consider replacing it with an Individual Term Life, Disability and/or Critical Illness Insurance product. The insurance coverage you choose can more than cover the balance you have owing on your mortgage. There are many Term Life Insurance options to choose from. If you buy mortgage insurance through the lender it has post underwriting. Which means that after the death or injury of the insured they will decide if you will receive the amount.

Where as with Term Life Insurance the insurance company will do the underwriting up front and if you are approved so long as you are being honest in your application process and are approved you know your beneficiary will receive the benefits, not the bank, then your beneficiary will receive the funds and can decide what the most urgent matters are for the money. A mortgage balance declines over time but mortgage insurance pricing will increase at every renewal as you will be older and may have health conditions come up, andit is a declining amount of coverage and will go straight to the creditor instead of your loved one. Term insurance is usually much less expensive than true Mortgage Insurance

Speak to an Experior Financial Associate about types of policies and how they can benefit you and save you from paying mortgage insurance premiums.

As well you may want to ask about Critical Illness and Disability insurance so that you can cover your costs should you become sick, have an accident or become disabled. It’s good to ensure all your bases are covered, especially if you have dependents.

Why is Creditor Mortgage Protection Insurance a Bad Idea?

When you purchase a home or condo you start with a down payment and you may use conventional loans, a home loan or you may choose to go with mortgage lenders. Generally at purchase it is advised from your agent that helped you receive your loan that you buy mortgage insurance from your bank or lender. They do receive a commission or kick back from this on top of a commission for your mortgage. As you make your monthly mortgage payment each month and pay down the amount you owe on the home, your Creditor Mortgage Insurance Premiums do not reduce, even though the amount owed to the bank reduces. At renewal premiums will be higher as you will be older and also you may become uninsurable as well. An Individual Term Life (Mortgage) Insurance premium does not go down with the principal amount owing on your home, any extra left over after paying off the mortgage is left with your beneficiary. Or they can decide to do something different if say medical expenses need to be paid or a child needs to go through University or College. You will continue to make the same monthly insurance payments even though your mortgage payments bring down the amount you need coverage for. You can adjust your insurance coverage with your Experior professional as your needs change throughout the years.

You may think you require creditor mortgage insurance but in fact you don’t. The beneficiary when you pay Creditor mortgage insurance is the bank that holds the mortgage. Creditor Mortgage insurance protects the lender. It minimizes their risk and it is often pricey. So it is good to look at other options that can be available to you. And most importantly because the creditor mortgage coverage is only underwritten at the time of claim, this leaves a question mark whether your premiums that you have been paying will actually qualify you for a claim payment.

This doesn’t sound like a great investment or plan of coverage after all and depending on how much you have left owing on your home it could be a big waste of money. This is why we recommend you speak with an Experior Associate.

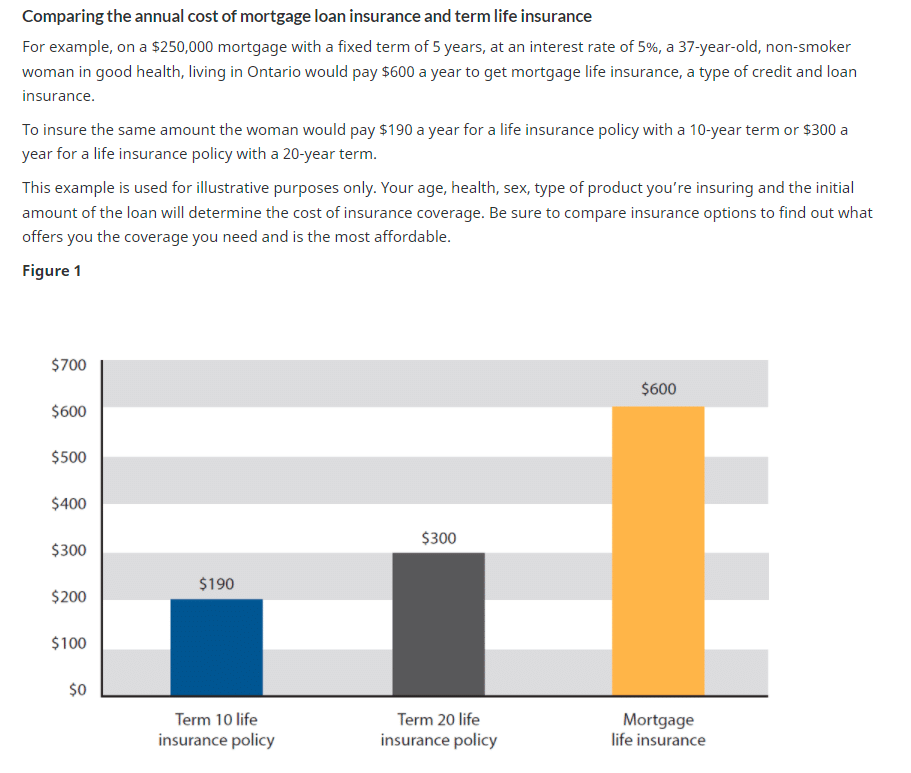

From the government of Canada website https://www.canada.ca/en/financial-consumer-agency/services/insurance/credit-loan.html

What Can I Do to Avoid Paying Creditor Mortgage Protection Insurance Premiums?

First you’ll want to review your Life insurance policy. Is there enough to cover the amount left owing on your home at this point? Does it have wiggle room to cover all your debts and the cost of funeral arrangements? If so you can call your bank and cancel your Bank mortgage mortgage insurance but we recommend you have one of our Experior Financial Group Associates review and assess your financial situation first. This service is complimentary.

Benefits of a Term Life Insurance Policy Over Creditor Mortgage Insurance

- Age - A Term Life Insurance policy may cover you up to age 85 (Most creditor mortgage insurance only covers you to age 70.

- Flexibility - The full payout goes to your beneficiaries to use as they prefer rather than directly to the bank.Your beneficiary may prefer not to pay the bank out at all.

- Locked In - The price will be locked in for the length of the term of your policy (10,20,or 30 years) rather than increasing every 5 years or whenever your mortgage term renews with creditor mortgage insurance. And Creditor rates are not guaranteed.

- Portable - If you decide to sell your home or property, the Individual plan is portable, and the policy will cover your next home or other family needs. The costs are guaranteed and can’t be changed.

- Policy - Creditor Mortgage Insurance does not issue you an approved policy. Only Individual Plans provide a policy contract for your protection.

- Underwriting - Creditor Mortgage Insurance is underwritten at the time of claim. This is the reason claims are not paid from the banks or lenders, Every year many many claims are not paid. Individual Plans are underwritten at inception. You will know from the 1st day of approval if you will qualify for a claim. Giving you and your loved ones peace of mind.

Why Speak to an Experior Financial Group Advisor?

Our Experior Financial Group Associates will do a walk through of your financial situation taking into account things like your loan balance, credit card debts, mortgage premiums, and any other debts you may have. The Associate will perform a full financial analysis and help you make the best financial decisions for you. An Associate will find you a policy that will meet your needs and take into account your monthly payments. Helping you make your monthly payment manageable.

Experior Financial Group Associates can also assist you with reaching your retirement goals and help you reach your debt freedom number sooner than you thought possible. Contact us for a free, no obligation Financial Needs Analysis.